This item may be available elsewhere in EconPapers: Search for items with the same title.

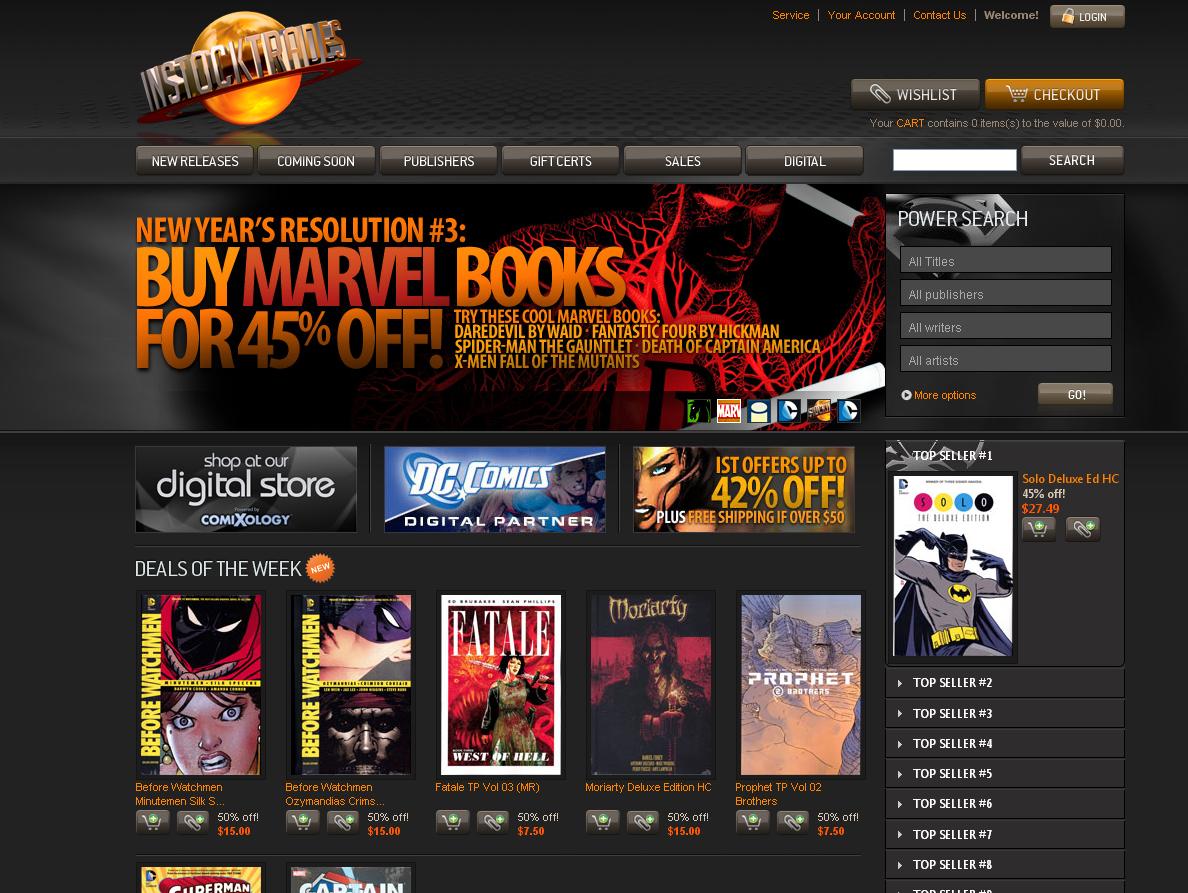

INSTOCK TRADE SERIAL

Working Paper: Trading Volume and Serial Correlation in Stock Returns (1992) We offer great prices on backup tape libraries, drives and parts from Sun, StorageTek, ADIC, Quantum, Overland and more top manufacturers. Complete your winning look with a BackRoad show blanket 34x42 in size, 8.5+ lbs with a tight weave and stamped wear leathers, these show pads are available. Working Paper: Trading Volume and Serial Correlation in Stock Returns (1993)

INSTOCK TRADE FULL

The model implies that a stock price decline on a high-volume day is more likely than a stock price decline on a low-volume day to be associated with an increase in the expected stock return.Ĭitations: View citations in EconPapers (568) Track citations by RSS feedĪccess to full text is restricted to subscribers. Changing expected stock returns reward market makers for playing this role. The paper explains this phenomenon using a model in which risk-averse "market makers" accommodate buying or selling pressure from "liquidity" or "noninformational" traders. We invest in a business to make money, similarly we can invest in a good company through stock. For both stock indexes and individual large stocks, the first-order daily return autocorrelation tends to decline with volume. Instocktrades uses thicker boxes (double-sided).

This paper investigates the relationship between aggregate stock market trading volume and the serial correlation of daily stock returns. The Quarterly Journal of Economics, 1993, vol. Trading Volume and Serial Correlation in Stock Returns

0 kommentar(er)

0 kommentar(er)